Social Security income benefits in the immediate future will continue to be the foundation of our retirement structure for those of us in the working middle class economically. Obviously, Social Security income benefits of 30 – 40 % of pre-employment income need to be supplemented to ensure your living expenses during the longevity of your retirement years are sufficient.

Since the debacle of the under-funded Defined Benefit Plans in the early 80s is mostly out of use because of the financial burden to maintain them. Companies, Government, Hospitals, School, etc… have to switch the financial burden for retirement need to the employees in the form of Defined Contribution plans which include 401(k), and the Thrift Savings Plan (TSP), and 403(b). These plans don’t offer a specific benefit amount of retirement income, it depends on how much the participant (that’s you) contributes and how the money was invested and grew over time.

Annuities are insurance contracts, and they allow money in a taxable account to have tax-deferred status—funds in annuities typically aren’t subject to capital gains taxes. However, funds withdrawn are generally subject to ordinary income taxes. If your income tax rate is higher than the long-term capital gains tax rate, an annuity may not be advantageous from a tax standpoint. This is one reason FINRA recommends most investors take maximum advantage of all other available tax-advantaged accounts before considering annuity products.

Another source of income for retirees may be an investment account with funds in stocks, Electronic Traded Funds (ETFs), equity funds, and other investments in the equity markets. If you have additional discretionary funds you have the potential to continue to grow your estate value. But most of us are in the mindset to seek the preservation of capital and minimize the effects of inflation. Yet we cannot dismiss the idea that you have real estate investments that can be a source of income.

Oddly a retirement income vehicle for retirement income that has been traditionally ignored and is now being considered feasibility for the middle call that is now gathering attention because of its potential to earn a greater return with interest deposit based on the performance of equity indexes such as the S&P 500 which provides for stability and flexibility. The leverages go beyond the original offering and provide family security protection, great cash value accumulation that grows tax deferred and can be used for retirement income tax-free.

2. Retirement Investment Accounts

Briefly, most retirement funding sources can be partially or wholly taxed at the ordinary income rate. But taking money from your retirement account requires some mental reprogramming on the tax front. You’ve been trained to avoid taxes. But for planning strategies consider switching gears and vehicles that allow you to avoid paying taxes. Therefore, in retirement, you have mitigated income that will put you at higher top rates.

Have you come to the realization that these features are made possible because of the strategies derived from the Internal Revenue Service (IRS) regulations for Cash Accumulation and Taxation of Life Insurance? Particularly reference is given to an Indexed Universal Life (IUL) policy, there are no taxes due during the accumulation phase when the policy’s cash value is building up. You can take tax-free distributions of the cash value when needed or when you retire. Also, it is possible you can use older whole-life policies that have cash accumulation and convert them to gain the leverages and advantages of an IUL policy without paying capital gain taxes. And when you pass the remaining death benefits passes on to the loved ones.

Indexed Universal Life insurance (IUL) policies are relatively new. As their name implies, their earnings potential is tied to an equity index. This gives the IUL cash accumulations the potential to earn higher returns if the market performs well. The potential for higher returns than traditional whole life insurance guaranteed cash value accumulations is because the credited interest is based on the performance of an equity index, such as the S&P 500.

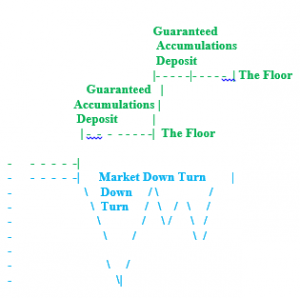

IUL policies give policyholders the option to allocate all or a portion of their net premiums (after paying for the insurance coverage and expenses) to a cash account. This account credits interest based on the performance of an underlying index with a floor of 0% return and a cap rate or participation cap on the return.1 The floor of 0% cannot be emphasized enough because if is the foundation of stability of the cash value accumulation (your capital) that is protected from losses. Thus, when the index is down the guaranteed cash accumulation deposit on the anniversary are in addition to the amount at the beginning of the deposit period. Essentially the floor prevents the need to catch up/recover from losses of cash accumulation just to get back to where the accumulations were before the losses occurred.

The zero (0%) floor is a valuable feature that provides a compelling feature to consider the use of IULs, but another feature adds on the positives. The IUL life insurance policy is somewhat like a retirement-income vehicle because a portion of the premium is placed for growth that pays an interest rate that matches that of an equity index. This provides a vehicle with greater upside potential and tax advantages that extend beyond the most common features of tax-deferred accumulation to the leverage that is a unique feature of Cash Accumulation Life Insurance. That is that IRS regulations allow for tax-free distributions of the cash value. IULs also allow the tax-free exchange of one policy for another without triggering.

Do you know the IRS guidelines that provide for withdrawals of IUL cash accumulations tax-free without treating the distribution as ordinary income?

DISCLAIMER:

Another lever that is as compelling to consider is that provides stability and flexibility for unforeseen circumstances of life. Consider the use of cash value accumulations to provide a protective buffer for liquidity in the form of tax-free funds when equity markets are in a downturn or other assets are depressed.

Possibly the flexibility to use death benefits in case of a Catastrophic Health Events of policies Accelerated Death Benefits (ADB) feature, not all policies have the ADB feature. In such an event, the insured/owner can obtain and use a portion of the policy death benefit fund/money. Those funds can be used at the discretion of the insured, in the event, the insured is diagnosed with certain catastrophic health conditions of Terminal, Critical, or Chronic illnesses and declares the ADB provision.